There is no greater investment you can make in your future than your education, to give you the skills and knowledge you need to start a rewarding career.

To support eligible learners with making this investment, Ontario provides publicly-funded financial assistance through OSAP. The Ontario Student Assistance Program (OSAP) is a financial aid program that can help you pay for college, offering a mix of grants and loans to help students afford their tuition, books, living costs, and transportation.

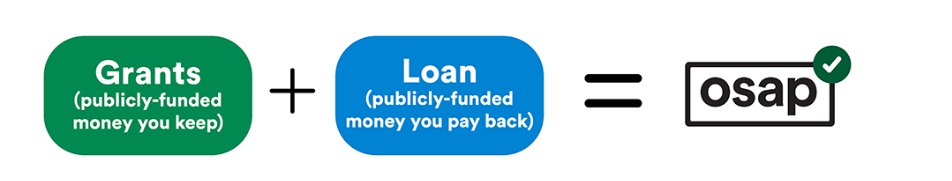

OSAP offers funding through grants and loan. When you apply, you are automatically considered for both grants and loan.

How is OSAP funding calculated?

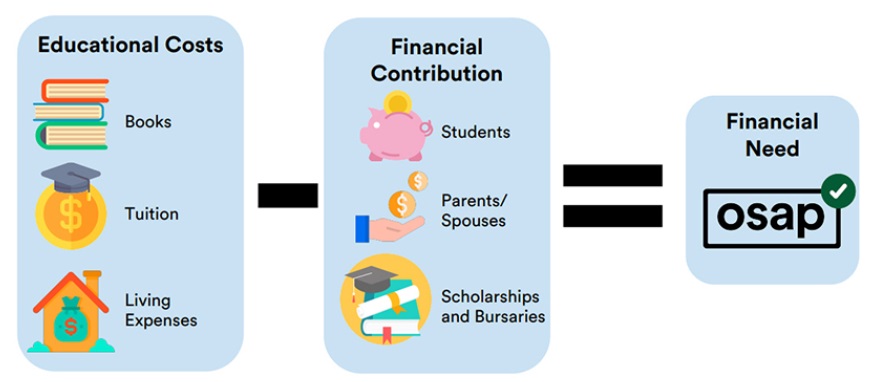

Eligibility is determined through a financial need assessment which considers your costs (such as tuition, fees, books and living expenses) as well as the financial resources available to you.

How much funding is available?

The amount and types of funding you’re eligible to receive are based on several factors, including your:

- Financial need

- Family status (e.g., single or married)

- Course load (full-time or part-time)

- Level of study (e.g., undergraduate, graduate)

- School’s location

You may be eligible for additional funding if you’re:

- An Indigenous student

- A current or former Ontario youth in extended society care

- A first-generation student

- A student with a disability

- A student who is deaf or hard of hearing

- A student who is in receipt of social assistance

Learn more at ontario.ca/osap.

The full-time maximum aid amounts are based on a weekly maximum and depend on where you’re going to school. For the 2023-24 school year, OSAP provides the following maximum assistance levels (grant and loan combined):

- $510 per week for single students

- $825 per week for students who are married or sole support parents

You are considered for a maximum of $300 per week if you attend a private postsecondary school outside Ontario, or a postsecondary school outside Canada.

On this page:

An introduction to OSAP

We recommend you review the OSAP website carefully to understand the application and approval process, and how you will receive your funds. It’s important that you meet all requirements throughout the process.

Take advantage of helpful tools on the OSAP website, including calculators to help you plan.

8 Tips for OSAP Success

When you apply for OSAP, there are forms, deadlines, rules, and responsibilities. These tips will help you get started and stay on track.

- Mark your calendar. There are many OSAP dates and deadlines.

- Pay the deposit first. You must pay your Mohawk tuition deposit before applying to OSAP.

- Take your time and read carefully. OSAP is a detailed process. Allow yourself time to avoid delays.

- Budget carefully. OSAP is paid in two instalments. Budget carefully to manage your commitments.

- Apply each year. OSAP is applied for each year. Understand all the rules to avoid surprises.

- Everyone should apply! When you apply for OSAP you will automatically be considered for loans (money you need to repay once you’re done school) and grants (money you don’t have to pay back). If you don’t want to take a loan, you can decline it after your application is approved.

-

Once you submit your OSAP application, you can no longer edit it. If, however, circumstances in your life change before or during your study period like your income, marital status, family size, access to transportation, etc., you must notify the Financial Assistance department in order to update your OSAP application.

- It’s not too late... You can apply for OSAP even after the start of classes and up to 60 days before the end of your study period.

Applying for OSAP

Full-Time Student OSAP Application

Use this application to apply for OSAP if you're taking 60% or more of a full course load or 40% if you have a permanent disability.

Micro-Credential OSAP Application

Use this application to apply for OSAP if you're taking a micro-credential.

Part-Time Student OSAP Application

Use this application to apply for OSAP if you're taking 20% to 59% of a full course load.

Continuation of Interest-Free Status

Use this application if you're not applying for OSAP and are in full-time studies. It will keep your previous full-time OSAP loans in interest-free status so you do not have to start repayment.

Get help with OSAP

Questions about your financial options? Contact Financial Assistance.

Follow us on social media for the latest financial news, tips and financial literacy resources.