Insurance - 318 - 368

Overview

Program Highlights

- Over 90% of our graduates obtain an insurance career position once they graduate.

- Mohawk has over 40years experience in educating insurance professionals. The insurance industry provides awards and scholarships in the amount of $10,000 annually.

- Very close links with the property and casualty (P&C) insurance industry.

- Upon completion of a common first semester, you may choose to transfer into second semester of one of the following programs:

- Business - Accounting (non co-op 316 or co-op 356)

- Business Administration (632)

- Business Administration - Accounting (364)

- Business Administration - Human Resources (363)

- Business Administration - Marketing (non co-op 362 or co-op 366)

- Business - Financial Services (303)

- Business - General (320)

- Business - Marketing (319)

Note: An additional requirement based on overall grades may be required to proceed into some programs.

What you'll learn

- Prepare for the Registered Insurance Brokers of Ontario License.

- Complete, on an accelerated basis, eight out of ten credits required for the Chartered Insurance Professional (CIP) designation from the Insurance Institute of Canada.

Program Length

2 academic years (periods of 8 months), plus optional co-op

Fast Track allows students to complete a two-year Diploma program (non co-op) in 16 months. Students will start in January and be in school for four continuous semesters: Winter, Spring/Summer, Fall and Winter. Students will not be off during the summer.

Important Academic Dates

We're here to help

We’re here for you to support applications and admissions by providing online and virtual service.

Applied and have questions?

The admissions team is available to help, you can contact them via Admissions or by phone at 1-844-767-6871.

Haven’t applied and need help?

Contact us or phone 905-575-2460.

Take a virtual campus tour

Explore Mohawk College from the comfort of home! Our virtual campus tours provide a guided visit of our buildings, labs, services, classrooms and athletic and recreation centre.

Program delivery

Learn about program delivery terms.

.

.

Admission

Admission

Domestic and International student admission requirements

- OSSD or equivalent (Mohawk Academic Upgrading, GED) including:

- Grade 11 Mathematics, C, M or U level or equivalent

- Grade 12 English, C or U or equivalent

Options are available for mature applicants.

Language Requirements for Applicants with English as a Second Language

- See below for accepted equivalents for Grade 12 English:

- Successful completion of the GAS-English for Academic Purposes (478 or 278) program

- TOEFL minimum score of 550 (80 Internet based)

- or IELTS Academic minimum score of 6.0 overall with no band less than 5.5

- More information about acceptable certificates, can be found on the International Admission Requirements

Applicants whose first language is not English will be required to demonstrate proficiency in English.

Don't have the necessary requirements?

Tuition and Fees

Tuition and Fees

2023 - 2024 Domestic Tuition and Fees

| Description | Semester 1 | Semester 2 |

|---|---|---|

| Compulsory Ancillary Fees | $864.60 | $758.46 |

| Co-op Fees | N/A | $422.22 |

| Compulsory Program Fees | $0.00 | $0.00 |

| Domestic Tuition | $1,354.04 | $1,354.04 |

| Total Domestic Charges Per Semester without Co-op | $2,218.64 | $2,112.50 |

| Total Domestic Charges Per Semester with Co-op | $2,218.64 | $2,534.72 |

| Total 1st Year Fees (Non Co-op) | $4,331.14 | |

| Total 1st Year Fees (Co-op) | $4,753.36 | |

Above fees based on full-time September program start date. Contact Student Services to confirm fees for other start dates or semesters.

- Full Cost Breakdown

- Explore payment options

- Book costs for your program can be found through the Campus Store

2023 - 2024 International Tuition and Fees

| Description | Semester 1 | Semester 2 |

|---|---|---|

| Total Tuition & Ancillary Fee | $8,355.00 | $8,355.00 |

| Co-op Fees | N/A | $422.22 |

| Program Compulsory Fees | $0.00 | $0.00 |

| International Tax Recovery | $450.00 | $375.00 |

| Total International Per Semester without Co-op | $8,805.00 | $8,730.00 |

| Total International Per Semester with Co-op | $8,805.00 | $9,152.22 |

| Total 1st Year Fees (Non Co-op) | $17,535.00 | |

| Total 1st Year Fees (Co-op) | $17,957.22 | |

If you pay by wire transfer, please note your bank might charge you a fee to transfer money. Make sure your transfer includes the Mohawk payment and the wire transfer fee. This applies to each wire transfer payment you make.

Additional Information

Financial Assistance

Financial Assistance

When it comes to paying for your education, investing in your future can be more affordable than you think. A Mohawk education is one of the most cost-effective means of acquiring the skills and knowledge you need to have a prosperous and rewarding career.

As you start on your chosen career path, it's important to have a realistic set of expectations regarding the expenses associated with attending college. In addition to your tuition fees, you will also need to budget for books, supplies, housing, and other related living expenses. You may be able to supplement your income and savings with scholarships, bursaries, or loans. It pays to do some research into what types of financial assistance you may qualify for.

Available Financial Assistance Resources:

OSAP Eligible. Learn about Ontario Student Assistance Program - OSAP (domestic students only)

OSAP Eligible. Learn about Ontario Student Assistance Program - OSAP (domestic students only)- Working on Campus

- Additional Sources of Funding

- Financial Assistance Home Page

Apply for Awards:

By submitting a Scholarships and Bursaries Application every semester, students have access to over $3 million in Mohawk College scholarships, bursaries and Ministry-partnered funding to help meet their financial needs.

Financial Literacy and Money Coaching:

Whether saving for school, sticking to a budget, or planning for a major purchase, financial literacy affects us all. That's why Mo' Money is committed to helping our students improve their money skills and become more confident with their money.

- One-on-One Money Counselling

- Complete the free online Money Matters Module to earn Co-Curricular Credit!

- Financial Resources and Calculators

- Events and Workshops

Program of Studies

Course Overview & Descriptions

Click on the course title for a course description.

Experiential Learning

Experiential Learning

How you’ll gain skills

- Experience interactive mock trials, and other simulations.

- Gain valuable experience during co-op work terms.

This co-op program has been accredited by CEWIL Canada. This represents the highest standard of achievement for co-op programs in Canada.

To learn more, please visit the Centre for Experiential Learning.

Students must maintain an overall 70% GPA per semester in order to maintain co-op status and have no more than one failed or withdrawn course.

Co-op Format (Fall Intake)

| September to December | January to April | May to August |

|---|---|---|

| Semester 1 | Semester 2 | Vacation |

| Semester 3 | Work Term 1 (Co-op) | Work Term 2 (Co-op) |

| Work Term 3 (Co-op) | Semester 4 |

Co-op Format (Winter Intake)

| January to April | May to August | September to December |

|---|---|---|

| Semester 1 | Semester 2 | Semester 3 |

| Work Term 1 (Co-op) | Work Term 2 (Co-op) | Work Term 3 (Co-op) |

| Semester 4 |

Co-op Delivery and Fees

This program has an optional co-op, as part of the program of study. The annual co-op fee structure can be found on the Tuition and Fees page.

For questions, please contact the Co-op Specialist listed at the bottom of the webpage.

Driver’s License and Vehicle

Please note that some co-op positions for this program require that students have a valid driver’s license and access to a vehicle. The license requirement (G class, G2 class) varies by position. Some co-op positions may require students to commute.

Co-op Designation

This program offers three co-op work term opportunities but requires two completed co-op work terms for the co-op designation.

Work Term Capabilities

(which do not reflect individual work experiences & exposures)

- Apply knowledge of insurance principles and practices

- Communicate insurance-related information in oral, written, and graphic formats suited to specific audiences and purposes

- Apply the knowledge of Canadian legal system, the legislative context of the insurance industry and business in general to insurance contracts, document and processes

- Recommend various insurance policies to clients from the perspective of the broker

- Evaluate the various factors affecting the acceptance and underwriting of any insurance risk

- Processing renewals, cancellations, endorsements for new business

- Explain, interpret, analyze policy coverage and policy documents

- Claims filing, document collection and report analysis

- Maintain abeyance systems to monitor outstanding insurance documents

- Microsoft Office, Excel, PowerPoint

| Co-op Pay Range | Co-op Pay Average |

|---|---|

| Range: $17.00 - $22.00 | Average: $21.50 |

For further information, please contact:

Jaime Harris, Co-op Specialist

Phone: 905-575-2164

Email: jaime.harris [at] mohawkcollege.ca (subject: Insurance%20Co-op%20Inquiry) (Jaime Harris)

Learning Outcomes

Learning Outcomes

Program Learning Outcomes, often referred to as ‘Program Standards', set out the essential learning that a student must achieve before being deemed ready to graduate.

- Review the program learning outcomes for Insurance (318)

- Review the program learning outcomes for Insurance (368) - co-op

In many cases these program learning outcomes were developed by the Ministry of Colleges and Universities (MCU) in consultation with employers and educators who are experts in the program field. To ensure the outcomes remain current and in line with industry needs, we invite our employers, graduates working in the field and current students to re-examine and update them during regular, ongoing program review focus groups.

Career Opportunities

Career Opportunities

Your future career options

- Underwriters

- Claims Adjusters

- Brokers/Agents

- Risk Managers

- Company Field Representatives

- Mediators

- Fraud Investigators

Where you could work includes:

- Insurance Companies

- General Business Organizations

- Independent Adjusting Firms

- Insurance Brokerages and Agencies

Opportunities for grads

- Chartered Insurance Professional (CIP) Designation.

- Registered Insurance Brokers of Ontario (RIBO) licence.

- Insurance Institute of Canada member

- Insurance Brokers Association of Ontario (IBAO) member

- Ontario Insurance Adjusters Association (OIAA) member

- Canadian Independent Adjusters’ Association member

- Ontario Mutual Insurance Association member

- Students may choose to register for the CIP national exams at an additional cost in order to receive credentials awarded by the Institute

- Mohawk offers a one-week Intensive Registered Insurance Broker course (RIBO) at the college for Insurance Program graduates who have successfully completed their fourth semester of the Insurance program in spring who wish to obtain their basic broker level one license

- In collaboration with IBAO, and Insurance Brokers Association of Hamilton (IBAH), Mohawk College is offering the graduating students of the Insurance Diploma program an accelerated training program specifically designed to prepare students to challenge the RIBO Level I Licensing Entrance Exam.

RIBO Level I Licensing Entrance Exam

This course prepares the student to challenge the exam.

In this five-day accelerated training program students will complete an overview of the Fundamentals of Insurance Textbook. OAP 1 Wording, Comprehensive Homeowners, Wording, Travel Insurance and RIBO Act.

Regulations

Upon completion of this course, the student will be qualified to be an "other than life" Insurance Broker as defined in the Registered Insurance Brokers Act, RSO1990 and its regulations. In order for a student to obtain a RIBO registration, it is necessary that employment be obtained with an unrestricted broker within 12 months of the date of passing the examination.

The student will receive a Level 1 "unrestricted registration". After 2 years working as a restricted broker and successful completion of the Advanced Broker respective examinations, this restriction can be removed.

A restricted registration permits a broker to put into effect any type of Property and Casualty coverages, but the broker is required to have sufficient knowledge of the coverages in order to handle the client's needs in a professional and competent manner.

Successful candidates may gain employment through any Registered Brokerage in the Province of Ontario. If a candidate does not become employed and registered within 12 months, the student will be required to re-write a RIBO examination.

The Insurance Brokers Association of Ontario, IBAH, Mohawk College and the Instructors are not responsible for obtaining such employment or recommending employment opportunities.

The Course

The Basic Broker Preparation Course satisfies the Basic Broker Skill Requirement as established by the Registered Insurance Brokers of Ontario (RIBO). It is a lengthy and fast-moving course that requires attendance at all lectures. It is recommended that a student spend a minimum of 3-4 hours in private study between each lecture. Emphasis is placed on Insurance Principles and personal automobile and property coverages.

Frequent Quizzes are given throughout the course and allow the student a measure of his/her accomplishments to date. A review exam will be supplied covering all course subject matter in preparation for the RIBO exam. These quizzes and review exam do not contribute to the RIBO exam or marks.

The RIBO exam will be written following course completion as per the IBAO.

The Exam

The examination is set by the Registered Insurance Brokers of Ontario. The student is required to submit an examination application and pay to RIBO the examination fee of $250 in addition to the course enrolment fee. This examination fee, application, two passport size photos and a Criminal Record Verification are due on the third week of April to Nansi Alkhassi.

The examination of 3-hour duration contains 100 multiple choice questions. The candidate will be supplied with the Ontario Automobile Policy for reference purposes. The student must obtain a mark of 75% or higher to be successful.

Re-writes are limited to 3 examination attempts in a 12-month period. The re-write fee is $250.00 for each attempt.

Course Date and Time

Course Dates: The course will be taught in the month of May following the graduating term of the fourth semester students.

Course Times:

- Monday to Friday Hours to be determined by the facilitator.

- RIBO Exam date will be determined by the IBAO after the course is completed at

the college. This will be a virtual proctored exam.

Location: Mohawk College, 135 Fennell Avenue West, Hamilton, ON L9C 1E9

Course Fee: $499.00

Examination Fee: $250.00

Hard Copy Textbook Fee or PDF Copy Textbook Fee: $235.00

You must submit a "Criminal Record Verification". See application for instructions and how to obtain this form from your local police department.

In addition, the student will be responsible for the RIBO exam fee of $250.00 which is to be submitted to the IBAO the third week of April. You will be notified by Jorge Bettencourt when the RIBO exam application is ready for completion. He verifies that you are in graduate status in order to be eligible to take this licensing course.

The Course Fee is payable to:

Mohawk College of Applied Arts and Technology

135 Fennell Avenue West

Hamilton, ON L9C 1E9

The Examination Fee is payable to the Insurance Brokers Association of Ontario.

Request for Application for Registration Form

- Download the Insurance Brokers Association of Ontario Application (PDF) for Basic Brokers Preparation Course.

- Download the Student Item Request Form (opens PDF, 95kb) to take to The Registrar's Office to make a payment.

Course fee of $499.00 must be paid at The Registrar's Office. Proof of payment must accompany application and be included with your completed registration package. Exam Fee of $250.00 is to be paid by certified cheque/money order and made payable to Registered Insurance Brokers of Ontario, and dropped off to M Wing with your completed Registration Package.

Please email Nansi Alkhassi at nansi.alkhassi@mohawkcollege.ca for additional information or questions.

Educational Pathways

Educational Pathways

Pathways to Mohawk

If you've successfully taken a course at another post-secondary institution, you may be able to earn course exemptions toward your credential here at Mohawk.

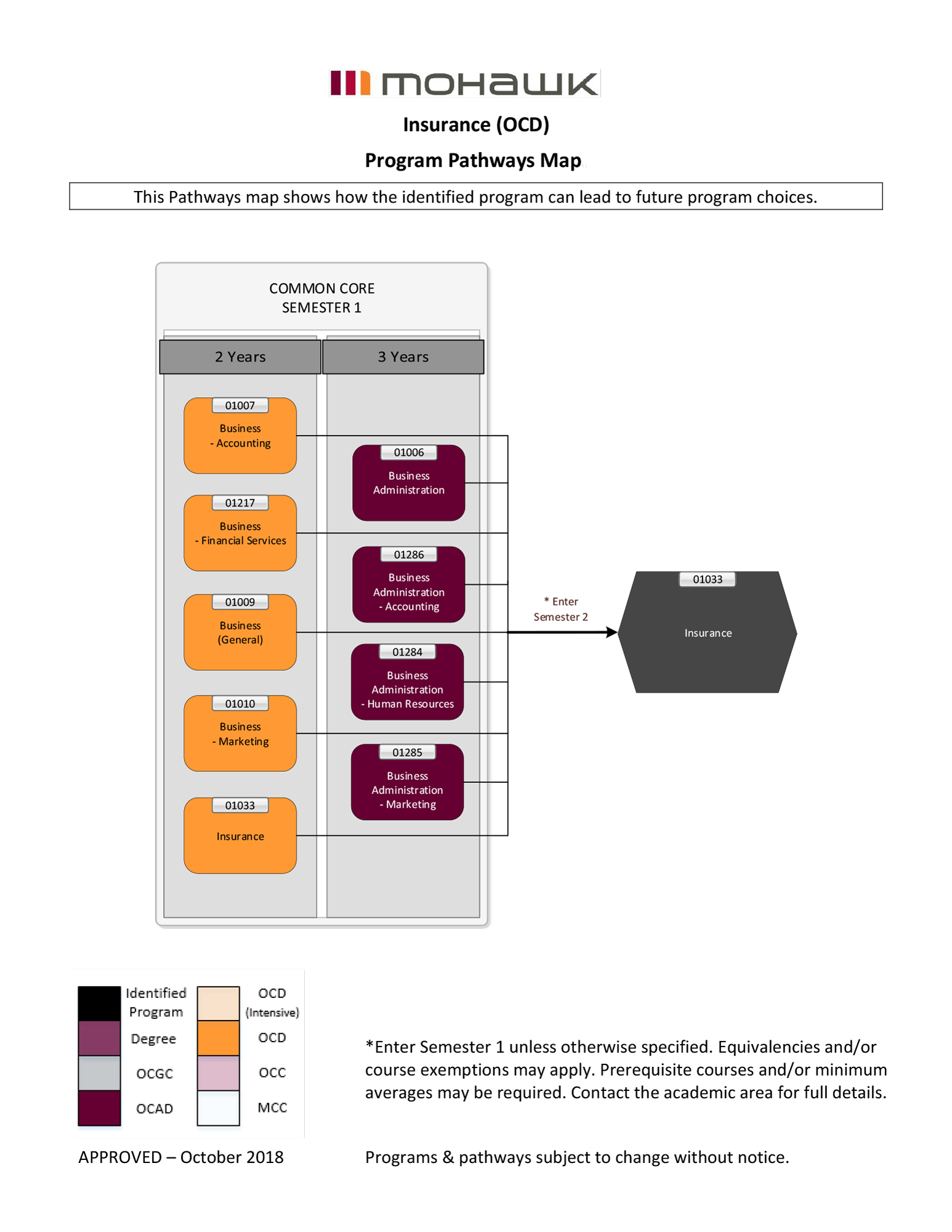

Pathways within Mohawk

If you have successfully completed one of the following programs at Mohawk, you may be eligible to receive transfer credit in this program. *

- Business - Accounting

- Business - Financial Services

- Business (General)

- Business - Marketing

- Insurance

- Business Administration

- Business Administration - Accounting

- Business Administration - Human Resources

- Business Administration - Marketing

This Pathways map shows how the identified program can lead to future program choices within Mohawk.

Pathways beyond Mohawk

Earn a degree:

- Davenport University - Bachelor of Business Administration

See ONTransfer for additional opportunities at other colleges or universities in Ontario.

Search the Mohawk Transfer Database for opportunities outside of Ontario.

Additional Information

Additional Information

Video Resources

Why Mohawk? Insurance Program Testimonials

Dan Lawrie - What Employers Look For When Hiring Mohawk Grads

Economical Insurance - What Employers Look For When Hiring Mohawk Grads

Aviva Insurance - What Employers Look For When Hiring Mohawk Grads

Cowan Insurance Group - What Employers Look For When Hiring Mohawk Grads

Crawford and Company - What Employers Look For When Hiring Mohawk Grads

Property & Inland Marine - What Employers Look For When Hiring Mohawk Grads

Dufferein Mutual Insurance - What Employers Look For When Hiring Mohawk Grads

Faculty

Program Coordinator

Faculty

Contact Us

Contact us

Domestic Canadian Students

Contact Student Recruitment

Haven’t applied yet and have questions?

Contact our Student Recruitment team for information on programs, how to apply, and more.

Contact Admissions

Contact our Admissions advisors for help with your application.

Contact Admissions

Phone: 1-844-767-6871

International Students

Contact International Student Recruitment

Contact our International Student Recruitment team for information on programs, how to apply, and student life.

Contact International

Email: intl.representatives@mohawkcollege.ca

Phone: 1-905-575-2254

Toll free phone numbers:

For general questions: 1-888-Mohawk9 (1-888-664-2959)

North China: 10-800-714-2521

South China: 10-800-140-2541

Brazil: 0800-022-7408

Philippines: 180011102544

Contact International Admissions

Contact our Admissions advisors for help with your application.

Contact International Admissions

Phone: 1-905-575-2254

*Not all programs are international eligible. Please see our programs available for international students.

Accessible Learning Services

Are you a student with a confirmed or suspected disability? Visit our Accessible Learning Services website to discover how we can help you.