So, you just secured that job you've worked so hard for and you’ll be graduating soon (or maybe you already have). There are several priorities you need to establish in order to get the most out of your earnings. These habits will also leave you in a stronger financial position.

Budget Priorities of a New Graduate

- Identify your “needs” and your “wants” and limit spending on “wants”.

- Build an emergency fund for unexpected expenses.

- Pay off your student loans!

- Build a great credit rating by paying off all your bills on time.

- Start saving! Look into the basics of banking or your employer’s pension plan. The more money you put into them, the more money you’ll have in the future.

Life After Mohawk Monthly Budget

Now that you have organized your priorities, we come to the most exciting part: budgeting. This is an important tool as it controls your spending, allows you to overcome unexpected financial changes and helps you achieve financial goals you have set out to accomplish.

Download Life After Mohawk Budget infographic PDF (opens PDF, 2.8mb)

|

Life After Mohawk Monthly Budget |

||

|---|---|---|

| Salary (before deductions): $3,337.00 |

Deductions: Benefits $99.00 Pension Plan $107.00 CPP, EI & Income Tax $683.00 |

Take Home Pay (after deductions): $2,448.00 |

| Expenses | ||

|---|---|---|

|

Household Items (15%-20%): Cleaning supplies Utensils _______ $280.00 |

Utilities (5%-8%): Hydro Cable & Internet Phone _______ $180.00 |

Housing (25%-35%): Taxes Insurance _______ $700.00 |

|

Transportation (10%-20%): Fuel Maintenance _______ $360.00 |

Clothing (2%-6%): Casual Family _______ $50.00 |

Health (2%-8%): Specialist Over the counter _______ $50.00 |

|

Debt (10%-20%): Credit Cards Car loans _______ $360.00 |

Manscaping (5%-8%): Toiletries _______ $125.00 |

Entertainment (5%-8%): Alcohol Movies, hobbies and recreation _______ $125.00 |

| Leftover |

|---|

| Leftover (5%-10%): Could be used for

Savings Unexpected expenses Future purchases _______ $218.00 Moe has properly budgeted his income and has money left over every month. Note: The budget has a range given for each category in order to cater to personal lifestyle and habit, and the dollar amounts outlined are estimates within those ranges. If money in a particular category is left over, the remaining amount can be used to pay down more of Moe's student debt or be put towards savings. |

Get an estimate (opens new window) of your anticipated position.

View an outline (opens new window) of your outstanding student loan amount and required monthly payment.

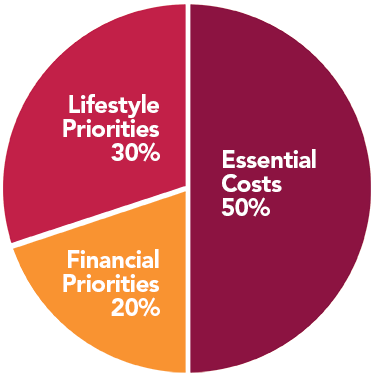

If you don’t want to keep track of too many expenses, consider the 50/20/30 Rule below.

The 50/20/30 Rule

- Essential Costs: These are "needs". Some examples include shelter, food and transportation.

- Financial Priorities: This will go towards debt repayment, savings and emergency funds.

- Lifestyle Priorities: These are "wants". They reflect what is important to you such as entertainment, hobbies and fitness.