Applying for the upcoming Winter 2026 semester?

Apply early to ensure a smooth registration process and to avoid delays with your funding. For more information and to apply, please visit the OSAP website.

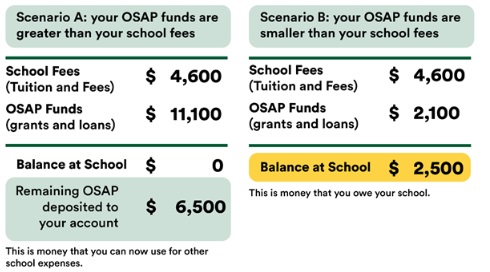

The Ontario Student Assistance Program (OSAP) is a financial aid program that can help you pay for college or university.

OSAP offers funding through:

- grants: money you don’t have to pay back

- a student loan: money you need to repay once you’re done school

When you apply for OSAP, you will automatically be considered for both grants and a loan. If you don’t want to take a loan, you can decline it after your application is approved. Eligible students must apply for full-time OSAP every year.

A student may request that their OSAP assessment or bursary eligibility be reviewed if they have a special situation that is not recognized in the standard OSAP or bursary assessment of financial need.

The following appeal outlines and forms will assist you in determining if your situation falls within an allowable review. If you have determined that your situation falls within one or more of the allowable reviews below, print off the cover page, attach all letters and supporting documentation and submit your package to the Financial Assistance Office for review.

All letters must be legible, signed, and dated and your student number must be clearly noted. Letters from third parties must include contact information for the person who is corroborating the situation and making a recommendation.

The deadline date for submission of a review to the Financial Assistance Office (FAO) or Ministry of Training, Colleges & Universities, including requests for reconsideration, is 40 days before the end of your study period All required supporting documentation must be submitted by the deadline.

A full list of OSAP forms and appeals can be found on the OSAP forms page and by logging into MyMohawk - Finances - OSAP Information - OSAP Appeals and Forms

OSAP Document Processing

The Mohawk College Financial Assistance Office does not review the following documents, as these are only reviewed by the Ministry:

- Proof of Bankruptcy; determines OSAP eligibility

- Income verification: non-taxable foreign income verifications, student, spousal, parent. Students have 1 year to submit proper documents; risk of grant to loan conversion

- Restriction appeals and income variance reviews

- Exceptional circumstance reviews

- Compliance reviews

It is very important to note that documents are reviewed in the order they are received and can take several weeks to months to process. The Financial Assistance Office cannot escalate or expedite this process.

To ensure your documentation is reviewed as soon as possible, students are strongly encouraged to upload their information directly to their online OSAP application. Instructions are provided to students through their OSAP account so students are encouraged to regularly check their OSAP mailbox for updates and further instructions.

Your OSAP Responsibilities

As a quick reference check out our OSAP Responsibilities page but everything you need to know about your OSAP loan and/or grant can be found on the OSAP website. It’s the most comprehensive and up-to-date resource you need. While there, be sure to familiarize yourself with information about eligibility and status, the interest-free period, repayment, and more.

Your OSAP loans are an important part of your financial life. While you’re a student we encourage you to learn financial literacy skills so you’re prepared when the time comes to repay your loan. Check out the many helpful resources on Mohawk’s Mo’ Money website.